If you are ready to refinance your home it is a good idea to determine how much you will save in mortgage interest over the term of your mortgage. It also good to know your savings over the term of home ownership.

The following mortgage refinance spreadsheet will help you to determine the real value in refinancing your home.This mortgage spreadsheet is provided as a free resource from SampleWords. It is available below for download.

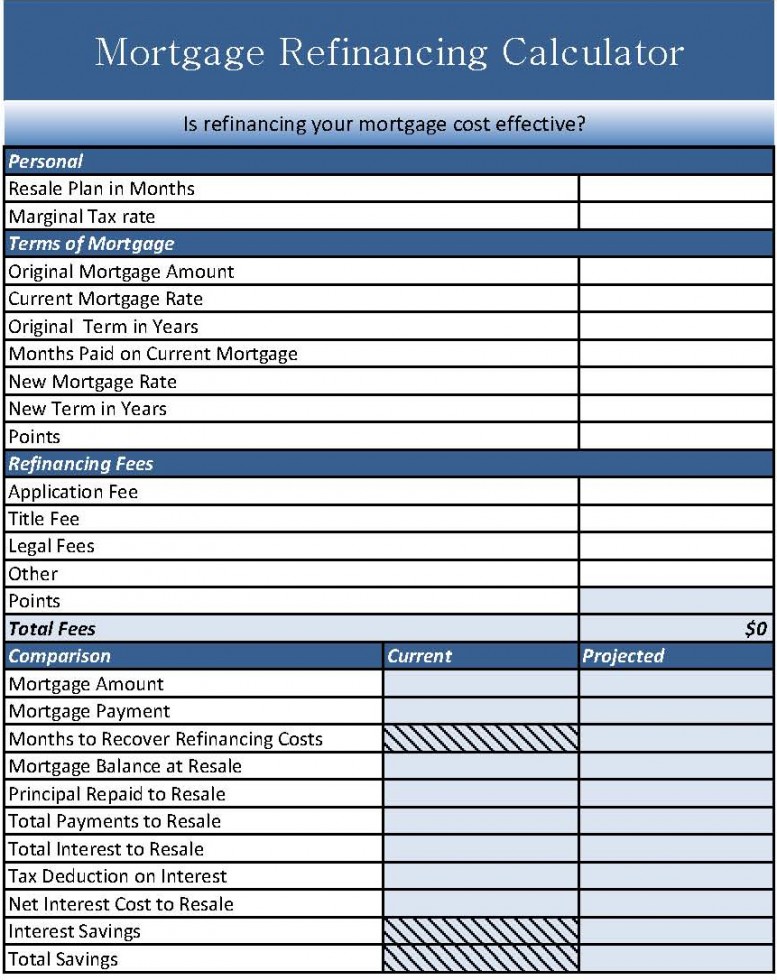

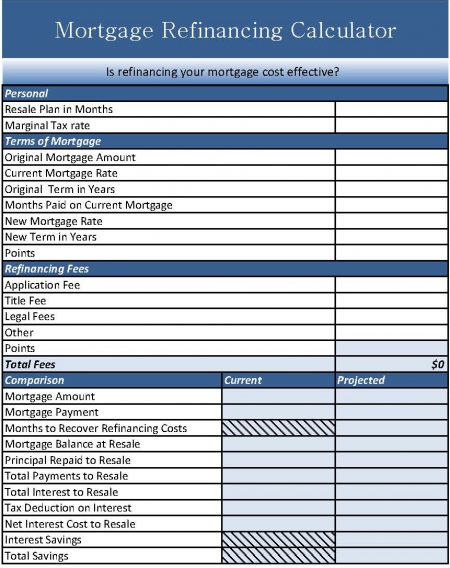

While you are exploring your refinancing options, you’ll be able to refer to this useful mortgage refinance calculator. An explanation of the form and instructions for using it are found below.

Download Mortgage Refinance Calculator – XLS

Explanation of the fields on the mortgage refinancing calculator

Resale Plan in Months: For how many months do you plan to keep your home? Calculation in months is necessary to provide an accurate calculation. Ten years is 120 months and 240 months is twenty years. Whether you plan to sell your home or remain there indefinitely, provide a number of months equal to when you plan to move OR the length of your new mortgage whichever is more. This number is important especially if you’re planning to sell your home in the future. This refinancing calculator will tell you how long it will take to recover the up-front cost of refinancing. If number of “Months to recover” is higher than the number of months you plan to keep the house it is possible that refinancing will cost you more money than you will save.

Marginal Tax rate: Your marginal tax rate is not your total income tax rate and it is not the current tax rate for capital gains. Your marginal tax rate is the tax assessed on your highest tier of income for the given year- based on which tax bracket your income qualifies you for. There is a very useful calculator provided at Bankrate.com that will help you calculate your marginal tax rate if you do not know it.

Original Mortgage Amount: This is the dollar amount originally financed when you purchased your home or when you refinanced your mortgage in the past.

Current Mortgage Rate: The interest percentage rate of your current mortgage. If your current rate is an adjustable mortgage, use the average rate you have been paying. For a general comparison you can add the beginning rate to the current rate and divide by two.

Original Term in Years: What was the term of the current mortgage in years?

Months paid on Current Mortgage: How many payments have been made? Many banks provide a payment coupon book that identifies each payment such as “Payment 64 of 360”.

New Mortgage Rate: Here you will enter the current mortgage rates offered by the institution(s) you might consider to refinance with.

New Term in Years: The duration of your refinanced mortgage in years. Will it be a 20 year mortgage or 15-year mortgage? etc.

The following Refinancing Fees will vary based on the institution you may deal with. You want to make sure to include fees when using the mortgage refinance calculator. Fees associated with applications, titles, legal fees, points and other costs will need to be quoted from the financial institutions you will be dealing with. For an illustration only, you can enter “1” in Points, and $500 in each of the fee boxes which might closely reflect your possible refinancing costs.

A note about PMI: If you originally bought your home with less than 20% down compared to the sale price or appraised value of the home at the time, chances are that you could be paying for private mortgage insurance (PMI). If refinancing your home with a position of equity greater than 20% you may be able to eliminate your monthly PMI payment. This would be a direct savings and immediate benefit to refinancing. Compute separately the projected savings from PMI if your loan should qualify. Often the elimination of PMI payments speeds up your “Months to Recover Financing Costs” significantly. You will need to add this difference to the total savings shown at the bottom of this spreadsheet based on what your PMI amount is per month multiplied by the number of months you plan to keep your home (Resale Plan in Months).