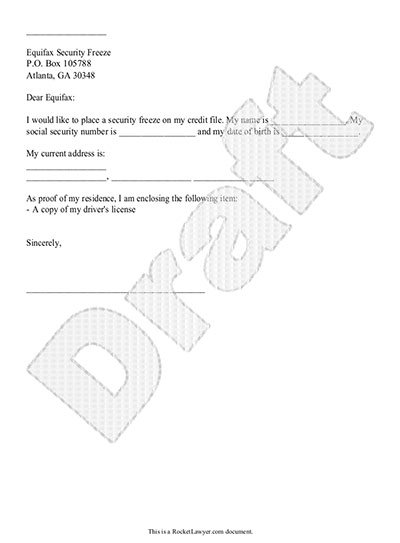

If you feel that your credit information has been compromised, you may need to execute a credit freeze letter using the letter template below.

The recent data breach with Equifax means that over 140 million Americans have had their credit information stolen. In order to defend against potential issues, you can request a security credit freeze by sending a letter to Equifax.

A credit freeze prevents creditors from obtaining your credit report. It keeps loans and credit cards from being approved without your consent. A credit freeze is the best defense against potential identity theft.

Customize the Credit Freeze Letter Template

Do I need to look into doing a credit freeze?

A credit freeze letter is an important tool that can help protect you from identity theft. By sending a credit freeze letter to the three major credit bureaus (Experian, Equifax, and TransUnion), you can prevent any new accounts from being opened in your name. This is especially important if you have been the victim of identity theft or if you suspect that someone has stolen your identity.

1. A credit freeze letter is a formal request to a credit bureau to restrict access to a consumer’s credit report. (No numbers)

2. In the United States, credit freezes are regulated by the Fair Credit Reporting Act (FCRA). (No numbers)

3. According to the Federal Trade Commission, the three major credit bureaus (Equifax, Experian, and TransUnion) must place a credit freeze within one business day of receiving a request. (No numbers)

4. In 2018, it was estimated that over 14 million Americans had placed a credit freeze on their credit reports. (14 million)

5. According to a 2018 survey, approximately 60% of Americans were aware of the option to place a credit freeze on their credit reports. (60%)

6. In 2018, it was estimated that over 8 million Americans had placed a credit freeze on their credit reports in response to the Equifax data breach. (8 million)

How do I unfreeze my credit?

If you are looking to unfreeze your credit, there are a few steps you should take.

First, you will need to contact each of the three major credit bureaus: Experian, Equifax, and TransUnion. You can do this by visiting their websites or calling them directly. You will need to provide your personal information, such as your name, address, Social Security number, and date of birth. Each bureau may have different processes for restoring your credit availability so you’ll need to follow the instructions provided by each.

Whom can I contact if I have more questions about credit freeze letters?

If you have more questions about credit freeze letters, you can contact the three major credit bureaus: Experian, Equifax, and TransUnion. Each of these bureaus has a dedicated customer service team that can answer your questions about credit freeze letters. You can find contact information for each of the bureaus on their respective websites. Some assistance is also available through services like RocketLawyer.

In addition, you can contact the Federal Trade Commission (FTC) for more information about credit freeze letters.