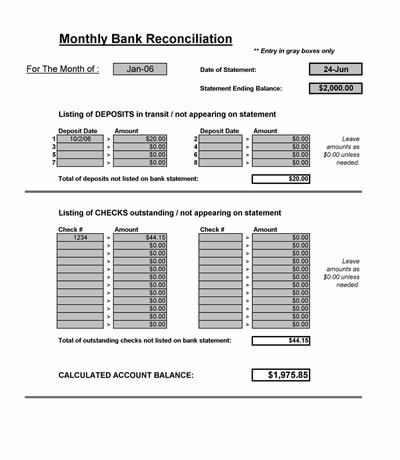

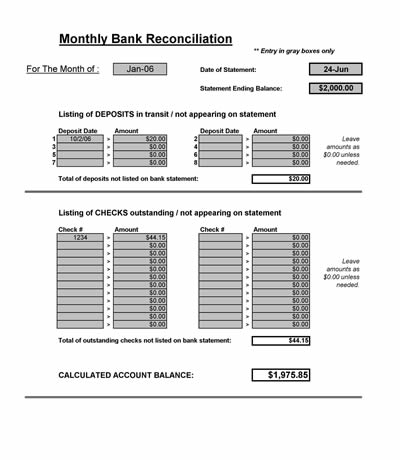

Download the free printable bank reconciliation spreadsheet below. This Microsoft Excel document allows you to quickly reconcile a checking account.

You can enter your checking account information such as date and statement balance. You can also enter bank deposits and bank withdrawals. The document allows you to quickly organize the bank reconciliation process.

The spreadsheet will automatically total outstanding checks and deposits. It calculates the reconciled account balance in order to compare that balance to the bank statement balance.

Download Bank Reconciliation Sample Spreadsheet – Excel

Bank Reconciliation Spreadsheet

Using the Bank Reconciliation Spreadsheet

- Obtain your bank statement. Print it out or open it in a browser window for online accounts.

- Obtain the records of your checks and deposits.

- Enter the statement ending balance.

- Enter all of your deposits that you have recorded in your records but are NOT in shown in the bank statement.

- List all the checks that are recorded in your records but NOT shown in in the bank statement.

- The spreadsheet will show a balance which should match your current checking account balance. If it does not then you need to check each check and make sure you have everything recorded properly.

Tips for Fixing Bank Reconciliation Errors

If you don’t get a matching number, subtract both numbers. If that number is divisible by 9, then you may have transposed a number in your records (recorded 54 instead of 45).

Sometimes older reconciled items get changed or deleted and that could throw off the reconciliation.

You may be missing a check or deposit. Look for an entry that matches the amount your reconciliation discrepancy.