This page includes several different free vehicle mileage log forms for tracking mileage.

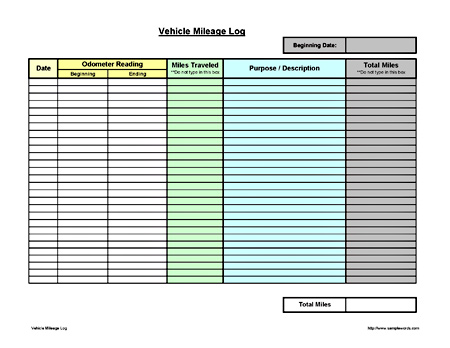

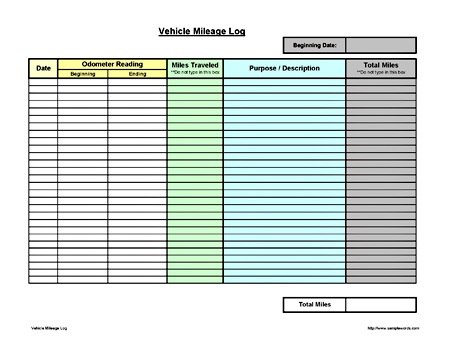

Our most popular form can be used to track mileage of your business vehicles for tax or other business tracking purposes.

The form includes beginning and ending odometer readings with columns to total trip mileage. You can also write down a description or purpose for the travel.

The mileage log was created as a simple document in Adobe Acrobat PDF format. This expense form was designed for you to print out and keep in the vehicle so you can enter your starting and ending miles using a pen or paper. (If you are selling a vehicle or need to report mileage, you can customize an Odometer Disclosure Form for your state)

Download Vehicle Mileage Log – Expense Form

Vehicle Mileage Log Expense Form

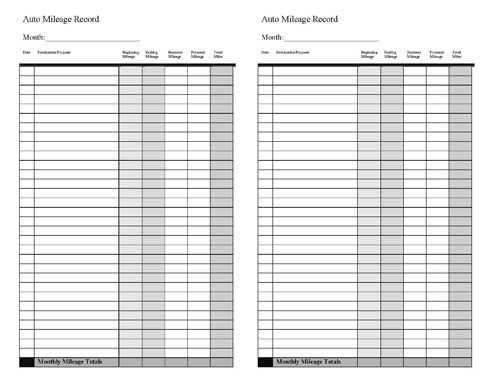

Auto Mileage Log – Form 2

This document also allow you to track mileage but is ideal for people that use their vehicle for both business and personal use. You can include the total trip mileage then deduce any miles driven for non-business purposes.

You will also notice that we include two tables per page printed landscape in the PDF document. This allows you to print multiple pages then cut the page in half and staple or attach each page for a small booklet that is easier to store in your car.

Download Auto Mileage Log – PDF

Auto Mileage Log

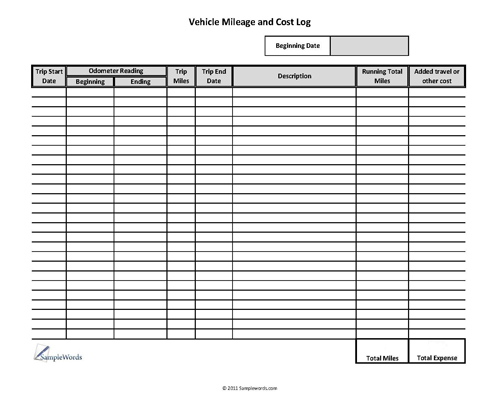

Vehicle Mileage Log and Cost Form 3

This version of the form provides the same odometer and trip mileage calculations as the first form.

There is an additional column of data that can be used to input additional costs incurred during personal or business travel. For example, you could note expenses for gasoline, lunches, meetings or other travel expenditures.

Vehicle Mileage Log and Cost Form

Download Vehicle Mileage and Cost Form

Tips on Keeping Mileage Records

Keeping a good record of travel miles will help you around tax time. You want to make sure you track the starting and ending mileage. If you use your personal car for business either make notations or only include business mileage.

When writing down a description, it’s a good idea to mention the reason for the visit such as business meeting. You may also want to include the specific location, individuals and type of businesses conducted.

For more tips on keeping a business mileage log, see:

Fool.com’s IRS Mileage Requirements